It’s now been 1 year since the FCA published their final guidance on the fair treatment of vulnerable customers and after a lot of reading of the guidance, question papers and articles, we’re probably all well versed in that firms need to ensure the fair treatment of vulnerable customers in their business model, culture and actions. Given that in October 2020, 53% of UK adults had characteristics of vulnerability(1) (a 7% increase from February 2020), half of a firms consumers could be at risk of harm so it’s absolutely vital that action is taken to ensure these consumers receive outcomes as good as those without vulnerabilities.

At a very high level, the FCA ask firms to be able to assess and respond to vulnerability. Their guidance provides ways that firms can do this and case studies to demonstrate what good and bad outcomes look like. We’ve seen partnerships in the industry to better support vulnerable customers, like Scottish Widows and MacMillan, to provide cancer support to customers living with and affected by cancer and the creation of the Financial Vulnerability Taskforce (FVT). The FVT are an independent professional body who aim to help firms improve their understanding of consumer vulnerability and encourage good practices and behaviours. In January this year, we saw the first company sign up to the FVT and their vulnerable customer charter; a set of 9 statements that supporters would commit to acting upon to better support vulnerable customers.

Other independent bodies and firms in the finance sector have been publishing their own guidance for treating vulnerable customers fairly which are in-line with the FCA’s guidance and these are helpful resources for firms looking to change their business models.

Some good things are happening and there’s a lot of talk about what firms should do, but I expected to see more action and examples of good practice being put in place. At the end of February, the FCA reported that between October and December 2021 they received 279 whistleblowing reports and 24% of these alleged against treating customers fairly(2) which shows much is still to be done.

One of the challenges I think firms might be coming up against is recognising and identifying vulnerability, especially for non-advice firms who have existing and long-term relationships with the customers. The characteristics of vulnerability are far reaching with huge variation and complex and so there’s no one-way to recognise vulnerability.

At this early stage, I think industry best practice to recognise vulnerable customers should focus on;

- Training

Some characteristics of vulnerability can be identified through interactions with consumers; over the phone, in writing, on email or on web capture forms. Staff need to be skilled to recognise signs of a potential vulnerability and know how to explore the matter further in a sensitive manner to understand if vulnerability exists. Additionally, any training should be conducted on a rolling period and not as a one-off exercise.

- Vulnerable Customer Screening

Not all characteristics of vulnerability will be detectable through interactions and not all customers will be forthcoming in disclosing them or even aware of them. Screenings can be used to spot signs of a potential vulnerability by making use of Psychometric Testing which is a scientific method to measure someone’s mental capabilities and behaviours. Screenings should be used within processes where there’s risk of harm to a vulnerable customer and when a new relationship is formed or existing customers are re-engaged.

- Create a safe space for disclosure

Vulnerable customers should have a safe space to disclose their vulnerability and whilst having all call handlers be able to empathise and act sensitively toward customers at all times would be optimal, we should consider other ‘safe spaces’ for customers to disclose a vulnerability.

Have a think about updating the forms you ask customers to fill in. For example, you could ask them simply and directly if they need additional support. Interactive Voice Response (IVR) phone systems could include an option to speak confidentially with a skilled person and online contact points can include confidential routes too or easy access to chat online with someone.

Contact Simplify Consulting today to see how we can help you better recognise, respond to and support Vulnerable Customers.

References

(1) FCA. (2021). FG21/1 Guidance for firms on the fair treatment of vulnerable customers. Available at: https://www.fca.org.uk/publication/finalised-guidance/fg21-1.pdf (Accessed 02/03/2022)

(2) FCA. (2022). Whistleblowing quarterly data 2021 Q4. Available at: https://www.fca.org.uk/data/whistleblowing-quarterly-data-2021-q4 (Accessed 02/03/2022)

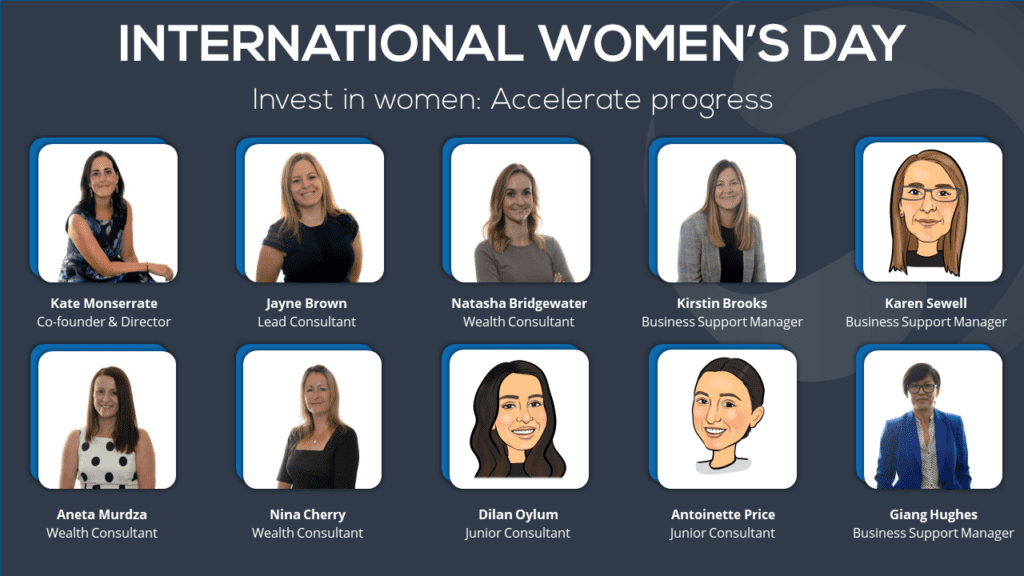

Natasha Birchall

Wealth Consultant