ESG is the new normal. Despite short term challenges, longer term ESG investor thinking will predominate. What then are the implications for wealth managers and how they can deliver against client needs?

Summary

ESG investing is taking centre stage, with a vastly increased year-on-year share of invested assets.

The Covid-19 crisis is without question the most significant environmental, social and governance challenge that most business executives have had to deal with. In the realignment of the economy, investors are keenly assessing how well firms have been able to weather the storm.

In the short term, the Covid-19 pandemic has created both some positive outcomes and serious challenges for ESG-related business practices.

However, the crisis has also demonstrated that good ESG factors appear to have resulted in better performance for firms, and ESG considerations are fundamental to how a business operates, and how it should be assessed from an investment perspective.

As it becomes increasingly apparent that good ESG is best practice, clients will demand it from their providers and investment strategies. More and more wealth managers need to be able to respond to clients’ specific ESG interests and demands, with access to ESG data and investment tools.

In this article we highlight some key toolkits and considerations for wealth managers to have on their agenda.

ESG investments are on the rise

ESG considerations and demand for ESG funds has been consistently increasing the last few years.

With an increase in demand for these funds, there are now over 6000 funds open to retail and institutional customers. Although equities are the largest sector amongst these funds, fixed income and mixed asset categories are growing.

Net fund flows into ESG mutual funds showed that from 2016 to 2017 there was limited new money invested into ESG funds. However there was a significant change of appetite in the autumn of 2017 corresponding to environmental concerns being discussed at that time. Up to July 2017 there was net £107 million invested in ESG funds. From 2017 up to March 2020 the total volume of trading doubled with net inflows of £3.6 billion, 34 times more than the previous period [1]. The Assets Under Management (AUM) represent 3% of the overall mutual funds market in the UK. ESG still remains small in terms of Assets Under Management against other funds but there are trends to show that ESG funds are becoming much more popular relative to their size.

There are a number of reasons for this increase:

First, investors are seeking to better align their investing behaviour with their principles -particularly the younger generation. On average, 64% of those aged 44 and under with an investment portfolio currently have exposure to this type of investment. This falls to 31% among those aged 45-54 and further to 15% among those aged 55 and over [2].

Second, there is a recognition that performance may not be given up by investing in sustainable investments. While the case for ethical investing, avoiding so-called “sin stocks” was unproven from an investment perspective, there is good evidence to suggest that an ESG lens adds value to a client’s portfolio (discussed further subsequently).

Third, regulation has driven transparency and scrutiny. For example, screening and stewardship practices need to be documented in annual reports, and the European Supervisory Authority Draft Technology Standards propose that asset management firms with over 500 employees need to disclose on their website what adverse impacts their investments have on the environment and society.

2020 was expected to be a key year for ESG themes

Before the Covid-19 crisis hit, the ESG trend was set to continue for 2020:

- Climate change was expected to have been a greater focus in corporate disclosures following increasing public awareness and concern

- The 26th session of the UN Climate Change Conference (COP 26) was planned to take place 9-19 November 2020 in Glasgow (now deferred to 2021)

- Firms’ business operations continued to be under scrutiny with attention on supply chain management and human rights issues

- Firms have been under increasing pressure to up their game in regard to cybersecurity & data privacy (e.g. the Equifax data breach in 2017 for some 147m customers cost the firm $425m [3])

In the short term, some aspects of driving good ESG practice through firms will be amplified and others may be compromised.

For example, in regard to the environment, we are seeing some short term positive climate impact through less flying and driving, and oil consumption has reduced in general; air and water quality have also increased and work from home practices are reducing firms’ carbon footprints. However, during this crisis, low waste / packaging is not a priority, polluting companies may be given some grace to keep afloat, and the low oil price is giving less impetus for alternative energy investments. The International Energy Agency has warned that the slowdown is likely to stall many government-funded green projects.

However, the crisis has also revealed in stark relief two key themes:

- Early indications suggest that firms with better ESG factors may have not been as adversely impacted through the Covid-19 pandemic, with less market impact on their performance or the funds in which they participate, and this is reflected in ESG funds.

- ESG factors can effectively provide an insight and highlight how well equipped a firm is to respond to key issues of the day. At its core, ESG considerations determine how fit a company is to do business, regardless of its sector (albeit certain sectors have greater ESG challenges than others).

ESG performance

In 2019, investors in ESG funds have seen high returns on their investments with some of the top ESG funds seeing returns of over 30% according to Morningstar data. Even those worst performing funds closed the year returning 3.7% [4].

The investments focus of the top performing funds include themes such as:

- Growth companies supporting health and wellbeing

- Companies with strong fundamentals

- Delivering improvements with less environmental impact

- Sustainable packaging industries

- Investment in technologies that source renewable power

- Companies who are helping to solve tomorrow’s global challenges

With the impact of Covid-19 on the global markets it is interesting to read positive insight on the performance of these funds with the ESG managers committed to proving that these funds are here to stay.

It may be too early to say that these funds have weathered the storm, although there have been some encouraging signs reported with the MSCI ESG Leaders indices having outperformed mainstream counterparts in most geographies. This analysis has indicated that the UK has been doing well when comparing the FTSE 100 ESG Leaders index against the FTSE 100 index. The FTSE 100 ESG Leaders index returned -27.3% year-to-date compared to -33.7% for the FTSE 100 index [5].

To back this up further data from Refinitiv, companies in the FTSE UK 100 ESG select index which includes the top 100 UK-listed companies with strong ESG practices have ‘comfortably outperformed the FTSE 100 index since the sharp market sell off that began on 21st February’ [6].

Since certain sectors, such as oil and gas, have more inherent exposure to ESG risk, the perception could be that other factors (such as the oil price) are favourably affecting ESG funds versus their non-ESG counterpart. However, the indices are constructed to be sector neutral, over-weighting better ESG companies in the sector in the ESG index, to allow a like-for-like comparison.

ESG consideration will become the norm

Public sentiment and interest in environmental, social and governance factors have become vastly heightened through the Covid-19 crisis – our personal and humanity’s interaction in general with the environment, how we act as a society in protecting the vulnerable, and how firms act during the crisis.

The public have seen how governments can and will respond rapidly with cash available for social and environmentally-led spending. The economic and social response to the Covid-19 pandemic is unparalleled on a scale not seen since the Second World War. After years of austerity and inaction towards climate change, the recognition that governments can move swiftly given the political will to do so, has set in place a precedent that action can also be taken in respect of climate change and social investment. Similarly, the broad acceptance of lockdown and behavioural limitations by society has demonstrated our ability to make rapid change to our social norms in the face of an urgent crisis.

These pressures will force firms to adjust, and regulation and enforcement will follow. Those firms most suitably adapted to ESG principles will be better placed to perform.

While pre-Covid most investors interested in sustainability were focussed on the E factors (of ESG), post-Covid there is an increasing interest in S and G factors, and so the investments in a portfolio and how well they stand up in regard to these factors will face greater scrutiny.

A number of factors have now been particularly highlighted through the pandemic:

- Environmental awareness – Business travel to reduce to essential only, building upon the technology foundations utilised for effective meetings experienced through lockdown. Virtual practices are recognised to be just as effective as face to face, and governance is being developed further to those practices to meet objectives.

- Supply chains – Short term, firms may choose to ignore, or worse, hide malpractice, but in general the Covid-19 crisis has amplified supply chain risks driven by working conditions and firms who have not addressed supply chain welfare may be disadvantaged. Poor and densely packed working and living conditions that contribute to the spread of the virus presents a business risk for firms with supply chains or outsourced services in affected countries. When employees have little or no job security, time off, or sick pay, it drives workers to continue to work regardless of potential negative health impacts. Better practice should be considered the norm for economic and risk reasons rather than solely ethical ones.

- Employee welfare – The Covid-19 crisis has led to social isolation, for many the death of loved ones, and mental and emotional health has been compromised. Bad firms are being called out and will be remembered by the public. Those that have demonstrated a greater responsibility towards supporting their staff will be rewarded reputationally and through a better performing workforce.

- Executive pay – Shareholders will not generally look favourably on executives receiving generous bonuses following a year where shareholders have lost out, even though the impacts of the virus are outside of companies’ control.

Investors will ask:

- Are firms prepared for environmental impacts?

- Did their practice through Covid-19 match up with their public messaging?

- How did they treat their employees, and are employees best supported to contribute positively to the corporate values and culture?

- Are they providing social benefit beyond the profit motive?

- Are they at risk from supply chain disruption from workers in the worse affected countries?

- Do they value the livelihood and health and safety of their supply chain workers as an asset?

- How do firms think about employee welfare, and the communities around them?

- Have they implemented remote working and reduced their carbon footprint?

- Do firms have the imagination to prepare for black swan events and weather them?

In a recent poll conducted by Calastone, almost 75% of those asked responded that ESG as an investment area would become the standard and of the same audience almost 60% said that most mutual funds would become ESG funds within the next decade. [7]

ESG-driven investment strategies

Wealth managers need tools to be able to profile clients for their ESG/sustainability preferences, assess companies and funds for how well they address these issues, and build and monitor suitable portfolios. Some wealth managers have reflected that these changes are too difficult to implement at this time. However such solutions are key to showcase to clients differentiated thinking sympathetic to client needs.

- Data is becoming available to help with this assessment. Firms like Refinitiv, Sustainalytics and MSCI all have ESG data and reporting offerings. There are now a number of categories and descriptions for ESG funds providing investors with an interest in ESG the ability to identify the funds that match the themes important to them.

- For firms that wish to undertake their own prime research AI tools are very well suited to ESG scoring, drawing data from multiple sources and diverse formats, but with specific search and assessment criteria, and there are solutions available that can be implemented easily for relatively little cost.

- Most suitability questionnaires are light on ESG/sustainability preferences, typically focussing sectors to avoid rather than specific areas to weight. However, there have been interesting developments in behavioural finance with some solutions available which recognise that “optimising” a portfolio for risk and return only and ignoring a portfolio’s “emotional return” is in fact sub-optimal for the client.

- Portfolio modelling tools are also being developed to help wealth managers assess a portfolio’s adherence at a granular level to specific themes that may be part of a client’s ESG investment mandate. ESG adherence of a fund or stock is generally 50 shades of grey across the different criteria, and so buying into a general sustainable fund may not specifically meet the client’s ESG requirements. For example, McKinsey cites Coca Cola as one firm rated highly for ESG compliance. Their rating is largely because they have set as a strategic priority three key themes – well-being, water and women. A Coca Cola investment for a client may therefore not meet the needs of an investor whose key concern may be climate change [8]. It is crucial that systems are put in place to understand clients’ ESG preferences and manage their portfolios in accordance with them.

Covid-19 has reminded us that the natural world can have a very rapid and major impact on societies and the systems we have built, and firms need to pay more attention to ensure they are prepared. In the long run, therefore, a focus on good ESG adherence will become more highly valued and the default way of doing business. How companies have responded during the pandemic will be under scrutiny and will drive investor investment views and needs going forwards. Tick boxes on sustainability are no longer sufficient.

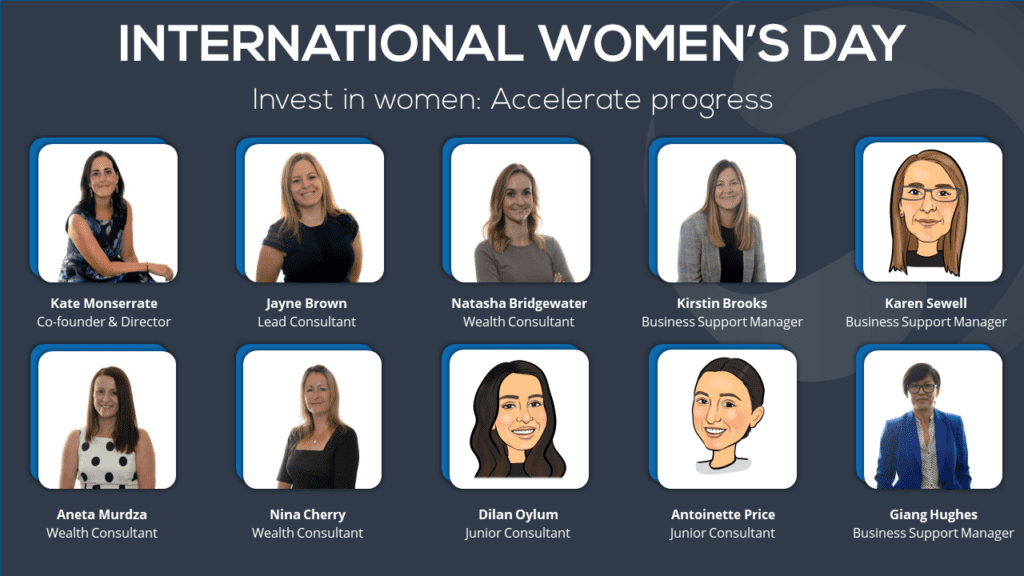

Co-authored by Miles Joseph and Jayne Brown.

Miles Joseph is an independent management consultant in wealth and investment management, helping firms with strategic advice, proposition design and the implementation of transformational change.

Jayne Brown is wealth consultant at Simplify Consulting. Simplify Consulting are practitioners in Wealth Management and Life & Pensions, working closely with our clients in project delivery, operating model design, risk management and business process optimisation.

Simplify Consulting. It’s what we do.

Sources:

[1] Calastone Webinar: The rise of ESG funds: a look at the ethical investing popularity explosion 30/04/2020

[2] Charles Stanley Direct research – Interest grows in ESG among UK investors

[3] Federal trade Commission – Equifax Data Breach Settlement

[4] Morningstar – Top Performing ESG Funds of 2019 – and the Worst

[5] Update from Schroders portfolio managers Katherine Davidson and Scott MacLennan, source BofAML research – Have ESG funds passed their pandemic performance test? A selector’s view

[6] Refinitiv – Green shoots of hope: How sustainable is performance spike in ESG funds post-pandemic?

[7] Calastone Webinar: The rise of ESG funds: a look at the ethical investing popularity explosion 30/04/2020

[8] McKinsey – Profits with purpose: How organizing for sustainability can benefit the bottom line