Sam Burrow

Consultant

..

As Simplify’s newest recruit, joining as a Consultant with a background in Project Management, I was really interested in learning more about how Simplify approach a project and selecting the right methodology. One thing I have really enjoyed since joining Simplify has been the pragmatic approach to projects. I have been operating as a Project Manager for a number of years, my background has been in Wealth Operations, specifically within Pensions and Investment Services functions. After spending several years as a team manager with projects at a local level, often on the peripheral of several larger projects, I moved into Project Management. I have always enjoyed routine, structure, knowing the road ahead and formulating a plan to get there and this meant project management was a perfect fit for me.

When I first started, the first bit of advice I was given was to do some research; gain a broader understanding of how project management worked before embarking on my journey. This initially led me to different project methodologies, and which one is ‘best’ to use for a project? In my previous role the methodology we used was usually pre-determined, but working at Simplify provides a new challenge, ensuring we take in to account the project and client’s needs, rather than sticking with a dogmatic approach. So how do we do this?

Waterfall vs Agile

The first two you will likely encounter when you search ‘project management methodologies’ are ‘Waterfall’ and ‘Agile’. Waterfall is a well-structured model, whilst Agile offers flexibility in its approach.

Agile has certainly become the most popular method within project management and some businesses will refer to themselves as ‘Agile’. But how much thought goes into deciding whether to become an ‘Agile business’, or which is the appropriate methodology to use for specific projects?

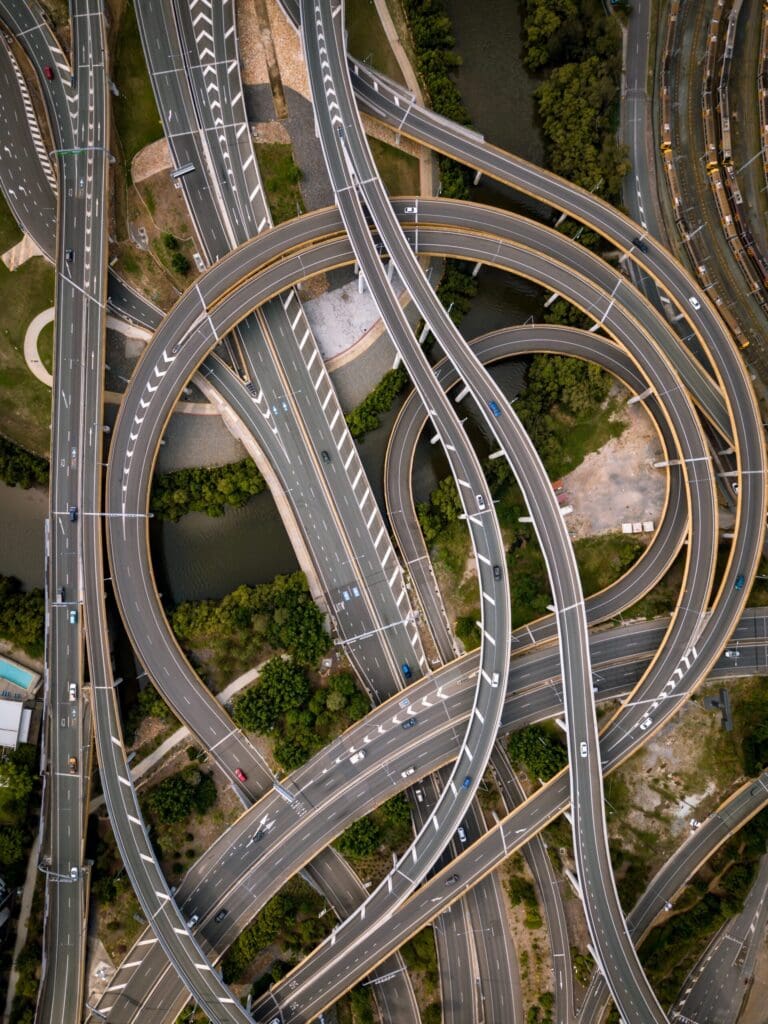

At Simplify, we take a pragmatic approach to decide the appropriate project methodology to follow. We analyse the client’s needs, look at the specifics of the project and the deliverables and whether the client has an existing change methodology and culture. We understand projects have varying levels of complexity, budget, resource, time and will tailor our approach, and which methodology to adopt, accordingly.

Which one should I use?

At Simplify, we believe there is no hard and fast rule when deciding which method to use.

Waterfall has been around for more than half a century and has become known as the ‘old school’ way of managing a project. It is a sequential methodology, following a specific order of events. For those project managers who are like me and have a need to arrange and order things with such exactness and precision (OCD to some!), this method may be perfect. Extensive requirements gathering, upfront budgets, a known end goal. But are these three things always known at the beginning of all projects?

Though the first thought among many is to rush and adopt an Agile methodology, it is important to take the time to assess each project on its own merit and we often find using the waterfall methodology is more suitable. Regulatory changes often fall into this bracket. The regulatory requirements are outlined, and a deadline date is confirmed to market. You can use these details to complete extensive upfront planning, defining a budget and adopting a linear project management approach to get there. Waterfall fits perfectly in this scenario.

However, projects have become more complex over time, teams have become larger, and our customer needs are ever evolving at a rapid pace. Rapid product innovation and the pace of change is driving businesses to adopt Agile as the default way of delivering projects. Though not always the right way to approach things, there is a reason why it has become so ubiquitous over the last few years. When done right it can deliver tangible benefits to the business, and it seeks to deliver those benefits as early as possible. If explained in those terms, it is not surprising that Agile has become so popular. The trick is to use it in the right context, and to adopt it in the right way. Some businesses will thrive pursuing the most Agile methods, where the change is geared heavily towards technology change, where teams can be assembled quickly (and even in rare circumstances co-located) Agile can be a perfect fit. Often what we see is that the real world prevents a true Agile model from ever becoming used and some degree of compromise, or a hybrid model of delivery is best.

A quick google search of the term ‘agile project management’ will show how popular it has become. You will find articles on ‘How to become an agile project manager’, agile project management job roles, plenty of agile qualifications, and a desire for companies to adopt the ‘agile’ project methodology. That is great, but I would challenge those companies to evaluate their own circumstances and ensure that the right skills are being used in the right way.

Within agile, project goals and objectives are constantly re-evaluated and consequently, agile teams are adaptive and flexible. Team communication and maintaining relationships is often more important than tools and processes. Agile allows you to respond to change quickly, developing a product or solution as you go along, always involving the customer or stakeholders along that journey. Large technology system transformations often opt with an agile approach due to its flexibility and ability to build upon its solution in iterative stages. A constant cycle of review, testing and implementation allows the system to be developed incrementally with the option to use parts of it in advance of the entire solution being completed. You can see why agile is becoming the universal method, but this should not mean the end of using more traditional methodology.

What does the future hold?

The overall ethos of agile has evidently become attractive to businesses, but truly understanding the approach and how to get the best out of it will determine whether it continues to grow. Some are aligning wider business on a common agile vision, making it their culture rather than just a project methodology to use.

We have not seen the end of the traditional waterfall method just yet but due to the ever-expanding need for new technology, flexibility, demand for faster results and adaptability, will this be fast on the horizon?

At Simplify, our model is not based on theory, it is based on real world experience and has allowed us to keep up with the ongoing demand in a project world. As projects evolve, we will continue to do the same.

If you need help structuring your change initiative or methodology, then please get in contact with us here at Simplify to see if we can help your business.