In the fourth part of our series on the Consumer Duty, we look at how Compliance and Oversight can be an enabler to delivering and ensuring ongoing compliance with Consumer Duty.

We’ve already seen how far reaching the Consumer Duty will be in impacting on products manufacturing and distribution, customer communications, and servicing in particular. It should be noted however that this does not mean that other areas won’t also be impacted, there will in reality be very few areas of businesses that it won’t touch in one way or another.

It is therefore going to be vitally important that firms have the right level of Compliance and Oversight in place to ensure that the regulations are considered across business lines, products and legal entities. There will need to be a level of consistency in application throughout a business, whilst also recognising the need for proportionality relating to the size, complexity and risk inherent in different areas. Compliance with Consumer Duty will not be a binary choice based on a clear set of requirements, it will only be achieved through the overall culture of the firm being aligned to the high level principle and focussing on the customer outcomes. That cultural shift within businesses will need to be supported by the correct governance and controls that can find where there may be an issue, or room for improvement in certain areas.

So what does this mean in practice for Compliance teams, and those responsible for overseeing the activities of the firm?

Increasing the compliance scope:

Ultimately, all activities that can impact on retail customers are now subject to the Consumer Duty. There will be little within most firms that escape the new rules completely. Compliance will need to review how all areas are currently overseen and adapt accordingly. Are those areas such as Product Manufacturing and Distribution, IT and Change Management all aligned to the principle of customer outcomes in everything they do? It is possible that more activities across the business will come under the scope of the regulatory framework, or that activities will need to be overseen with a different focus on the customer. At the heart of this oversight will be those measures and metrics, some of which will increase in importance going forward. Compliance will need to become involved with defining and monitoring the metrics relating to SLAs, customer communication channel usage, which they may have only previously been aware of at the highest level.

Change the mindset:

The governance by principle that Consumer Duty looks to extend will mean that the ways and means of ensuring compliance will need to shift as well. The existing rules do not go – firms will need to stay compliant with the various handbooks as they do now. However, firms will need to challenge themselves on their existing practices – some activities which are currently accepted may not be delivering the right outcomes for customers when critically assessed. Compliance will play a vital role in doing this, and their voices will need to heard within businesses.

A true compliance function, acting as an independent voice within the business, will provide that important perspective into the business. Compliance will need to be adept at challenging existing norms. They will also need to have a perspective on how the various rules will overlap and be open to new ways to doing things.

Compliance will need to work with the business, inputting into a culture which supports innovation to support the customer’s best interests. Re-imagining processes, the ways and means of customer communication, and delivering fair value may lead to a breakdown in the traditional ways of doing things within firms. Compliance needs to support these conversations and come on that journey with business leaders as well.

Understand the landscape:

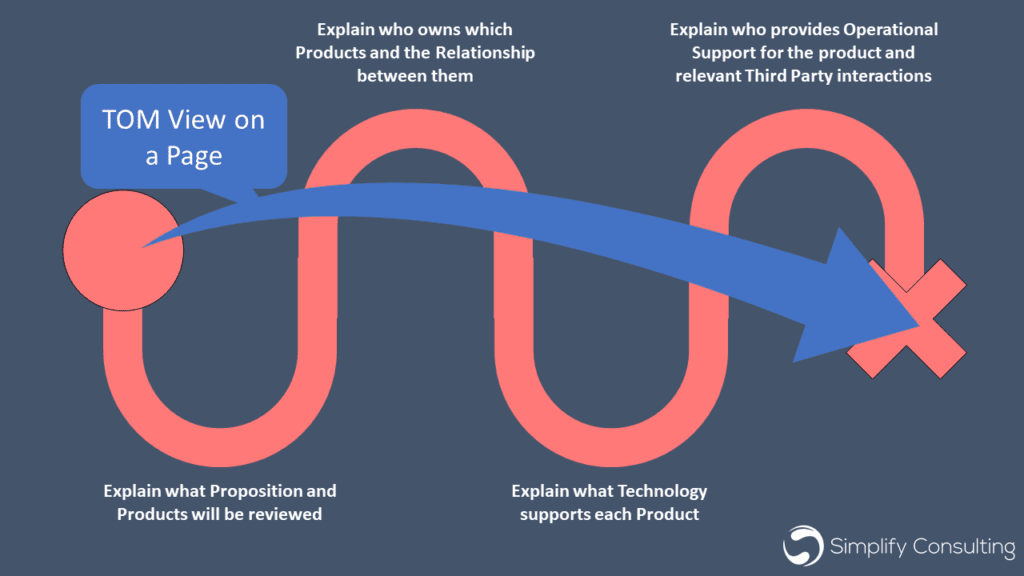

Understanding the big picture will be vital here. Delivering good customer outcomes will not be achieved by the introduction of a particular line on a letter, certainly not on its own. The overall customer journey will need to be viewed as a whole to understand the customer interactions and how the firm are supplying good outcomes, products, or service to the customer. Compliance will need to view things through that lens. They will also need to be clear about the vision and strategy of the firm and make sure that needless barriers are not put in place for individual processes. The change roadmap will need to be considered so that the true end state is understood, and compliance enable that vision to be achieved.

Deliver true governance and oversight:

Under-pinning of all these changes, firms will need to ensure that there is true governance and oversight throughout all the relevant activities. The requirements and metrics to measure the customer objectives will only be useful if there is the correct structure in place to govern those activities, highlight where there are issues, and take steps to escalate and address the root cause of the problem.

Forums, sub-committees that look good on paper may not always achieve the right results. Those on the ground, dealing day to day with customer requests do not always follow directive controls, even where the controls are documented and reviewed regularly. That is where the business needs to ensure that what is in place is appropriate, proportionate and functionable.

Metrics that have been designed are used constructively, to aid the businesses assessment of compliance, rather than becoming an end in themselves. Business leaders need to be held accountable for the decisions being made, and controls that put in place are being consistently applied to reduce the risk of errors. Senior Managers will need to ensure that they have a detailed understanding of the requirements within Consumer Duty so they can provide effective oversight, supporting the business and customers to achieve their objectives.

The Consumer Duty poses a change for compliance and oversight, it is also an opportunity to create an environment where the business is aligned to the customer outcomes in a way that hasn’t previously been possible. Compliance will be a large part of the relative success of the governance by principle if the opportunity presented is grasped.

Dom House

Lead Consultant